457 Deferred Compensation Plan

FPPA's 457 Deferred Compensation Plan allows Members to save and invest additional retirement funds during their career as a first responder. Participants are allowed to enroll and begin contributing to the plan at any time, as long as their Employer allows its Members to join.

What is FPPA's 457 Plan?

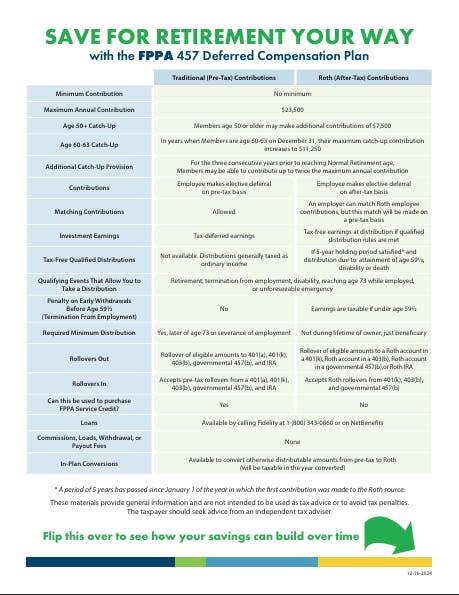

Similar to the more common 401(k), a 457 deferred compensation plan is an individual retirement savings plan. Unlike a 401(k), 457 plans are only available to public sector and some nonprofit workers, and there are no penalties for early withdrawals. Participants in FPPA's 457 plan make regular contributions into a self-directed investment account held at Fidelity Investments. Some Employers also make matching contributions for their Members enrolled in the Plan. FPPA's 457 Plan also allows traditional (pre-tax) and Roth (post-tax) contributions.

Enrollment

To enroll in FPPA's 457 Deferred Compensation Plan, first speak to your Employer or check this list to determine if your department participates in the Plan. If so, work directly with your department's payroll administrator to enroll.

Guide to Investing in FPPA's Self-Directed Plans - Brochure